The death of a spouse or partner can be one of life’s most devastating and stressful experiences. For many people, losing a partner takes a significant financial and emotional toll. Spouses often sacrifice time, finances, and their own careers to care for a partner in the period leading to their death. When their spouse passes away, a surviving spouse who is grieving their loss may find themselves overwhelmed with financial, administrative, and other obligations.

Some states have enacted laws and some state courts have held that surviving spouses are not personally responsible for their deceased partners’ medical debts, and others limit the circumstances in which a surviving spouse is responsible. Where debt collectors try to capitalize on a surviving spouse’s vulnerabilities by attempting to collect their deceased spouse’s unpaid medical bills without consideration of the specific facts and legal nuances that would be required to determine whether the bills are actually owed, these attempts to collect on these debts may therefore violate state and federal law.

Surviving spouses face significant challenges

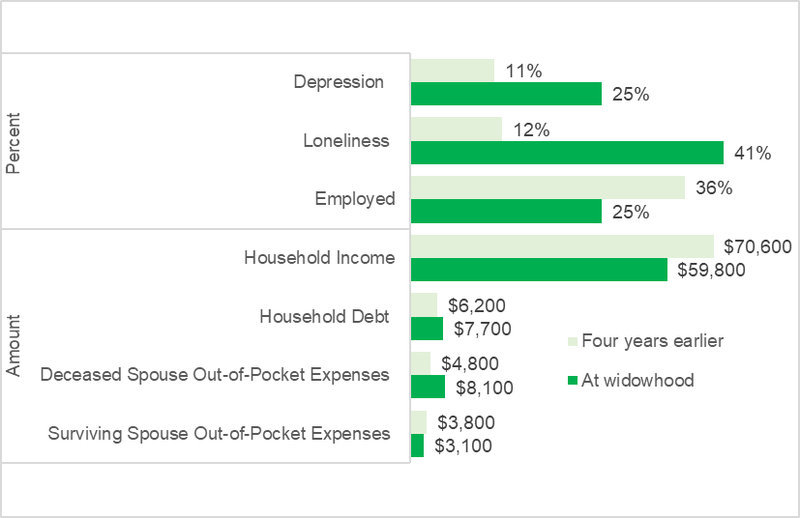

In 2022, there were 1.7 million adults in the United States who were widowed within the last 12 months. Two-thirds of new surviving spouses are women, and their average age is 71 years old. These surviving spouses face an array of personal and financial challenges. For instance, 25% of new surviving spouses report experiencing depression, and 41% report loneliness. New surviving spouses’ household debts are higher, and their incomes are lower than they were four years earlier. Only 1 in 4 surviving spouses report that they are still working, compared to 36% four years earlier. In the midst of these personal and financial changes, surviving spouses may receive debt collection attempts that are confusing and difficult to navigate.

Figure 1: Comparison of financial challenges reported by new surviving spouses compared to four years earlier

Source: CFPB analysis of longitudinal data from the Health and Retirement Study (2004 to 2020) and RAND HRS Longitudinal Files.

Surviving spouses are especially likely to report having unpaid medical bills, and those bills are greater than those of the rest of the population. New surviving spouses with unpaid bills report an average of $28,749 in unpaid medical bills, compared to $15,785 among the rest of the population. In the four years leading up to their death, the out-of-pocket expenses of the spouse who died nearly double while the survivor’s own expenses decline. This suggests that the high amounts of unpaid medical bills that surviving spouses report may reflect the bills of the spouse who died.

Figure 2: Frequency and burden of unpaid medical bills among recently widowed spouses

| Group | Percent with unpaid bills | Average unpaid medical bills | Median unpaid medical bills |

|---|---|---|---|

|

Widowed <12 months |

11% |

$28,749 |

$2,100 |

|

Rest of the population |

10% |

$15,785 |

$2,000 |

Source: CFPB analysis of the Census Bureau, Survey of Income and Program Participation 2018-2022, public use files (pooled sample).

Surviving spouses describe the impact of medical collections on their credit

While facing these financial and emotional challenges, many surviving spouses are contacted by collectors attempting to collect unpaid bills for the care of their deceased spouses. In complaints to the CFPB, surviving spouses express their concerns about the adverse impacts that attempts to collect the medical debts of their deceased spouse may have on their credit, and others specifically describe the adverse impact these collections have had on their credit ratings and credit access. For example:

My wife died of a [heart condition] at XXX Hospital…I signed no paperwork on the days of her hospitalization. Since then, no one has reached out to me for payment including the hospital or [doctors]. However, Colorado [provider] has been hitting me with numerous small bills (13 so far) totaling $8XX. As each has gone unpaid (my attorney said DO NOT pay unless you are prepared to shoulder all the previous bills), they have referred the collection to [debt collector] in Arvada, CO. I have spoken with them on numerous occasions and informed them ‘Chapter and Verse’ regarding Colorado law but they said ‘they don’t care’ and continue ruining my credit. At the time this started my credit was 780, went as low as 550 (all due to them) and is slowly back to 680 with almost no debt. I have reached out to the reporting agencies on numerous occasions but no joy.

[M]y husband passed away after a XXXX year illness that took nearly everything from us. We were foreclosed upon, and thankfully XXXX from the XXXX saved our home. In the process though, our interest rate was elevated to nearly 10%! My husband died XXXX years ago this coming XX/XX/XXXX, and I’ve desperately tried to refinance, qualify for other financial programs to no avail. My credit was destroyed by delinquencies related to medical bills, medical treatment, bills going unpaid so we could purchase my husband’s medication, travel, cost out of state for his treatment, etc. I am unable to refinance because of my credit score.

My spouse passed away [and] I received a bill later for a medical charge from XXXX, XXXX XXXX, CO. I sent a note back saying he was deceased. I received another bill and I sent a copy of his death certificate. Now I received a letter [debt collector] to ” COLLECT AND IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. ” I will be XXXX years old and on a fixed income due to his death…Am I responsible for his medical bill? Since they do not accept the fact that he died and see his death certificate, what can I do? Will this affect my credit rating?

The CFPB recently proposed a rule to ban medical bills from credit reports. This rule would ensure that debt collectors cannot use credit reporting to coerce surviving spouses and other consumers into paying medical bills, including medical bills, including inaccurate bills that they do not owe.

Collectors seek payment from surviving spouses, sometimes without checking the facts

Despite this proposed change to credit reporting, the CFPB remains concerned that debt collectors may mislead surviving spouses into paying their deceased spouses’ debts when they are not legally required to do so. In consumer complaints and listening sessions with legal aid and elder law attorneys around the country, the CFPB has heard that surviving spouses have been subject to payment demands and endured litigation because debt collectors demanded payment for their deceased spouses’ medical debts when they may have had no legal obligation to pay. If a spouse dies, their estate is usually responsible for paying any remaining bills. The survivor is generally not personally responsible for that debt unless it’s a debt the survivor also agreed to or the survivor is responsible under a state “common law” doctrine or legislation.

The historical purpose of the common law doctrine was to ensure that married women were able to purchase necessities on their husbands’ credit when their husbands refused to provide them or their children with food, clothing, and medical care that they could otherwise afford. By contrast, the doctrine is sometimes used today to hold surviving spouses personally responsible for their deceased spouse’s medical bills. Some state courts have determined that the doctrine of necessaries is outdated and that it is best left to state legislatures to identify the specific ways in which it may be relevant, if at all, today.

Some state laws make clear that surviving spouses do not personally owe their deceased partners’ medical bills unless they agreed to pay the debt when it was incurred. For example, Minnesota recently passed a law indicating that a spouse is not personally automatically liable for the medical debts of their spouse. Other states may hold surviving spouses personally responsible for paying some medical bills, but only in specific circumstances, such as where the surviving spouse has the ability to repay. However, it appears that some debt collectors may assert that surviving spouses owe medical bills without considering the specific facts and circumstances or nuances of the law that may affect the spouse’s legal rights. The Fair Debt Collection Practices Act and its implementing regulation prohibit misrepresentations from debt collectors. Debt collectors that attempt to collect a spouse’s medical bills from a survivor who is not legally liable may therefore violate the Fair Debt Collection Practices Act and state law, and it can further exacerbate surviving spouses’ personal and financial struggles.

The CFPB has also shown that the medical billing and collection system is filled with errors. When debt collectors try to collect a patient’s medical bills from a surviving spouse, they may be collecting on bills that were already incorrect or in the wrong amount. And when debt collectors incorrectly claim that a survivor is financially liable for their spouse’s medical debts, that is just another example of inaccuracies in the medical billing system.

The CFPB will continue to pursue debt collectors for attempting to collect amounts from consumers that are not actually owed. We will work with state regulators and law enforcement to help identify debt collectors who attempt to collect on medical debts without regard to state and federal law, and to ensure that surviving spouses are able to easily understand their rights and responsibilities.

Four tips to help surviving spouses facing medical bills to learn more and take action

- When a loved one dies and debt collectors come calling, surviving spouses should not assume they have to pay. Read our advisory for tips on dealing with debt collectors.

- Some nursing homes attempt to make caregivers personally guarantee payment of a resident’s bill as a condition of admission. This is generally illegal. Learn about caregivers’ rights when dealing with nursing home debt.

- People who have a debt in collection or have been sued by a debt collector can find a reputable lawyer to advise or represent them. Here are some ways to find a consumer lawyer.

- People who have experienced problems with debt collectors or credit reporting agencies can submit a complaint to the CFPB at cfpb.gov/complaint.

The CFPB has also developed a checklist to help people take control of their finances in the weeks and months following the death of a spouse or partner: Taking Control of Your Finances: Help for surviving spouses .