Source: site

The Commerce Commission says its draft decision on the interchange fees businesses pay to accept Mastercard and Visa payments would lead to a $260 million annual fee reduction, and see surcharges consumers are stung with drop to between 0.7% and 1% from an average of about 2%.

“We’re proposing a reduction of around $260 million a year to the largest component of the fees charged to New Zealand businesses to receive Visa and Mastercard payments. We’re also setting the clear expectation that payment providers and businesses should pass these savings on to customers,” says Commission Chairman, John Small.

“If our draft decision is implemented, we’d expect to see consumers benefit from lower surcharges of around 0.7% to 1.0%, or through prices of goods and services that reflect the lower fees. We’ll be doing more work next year to determine whether, and to what extent, regulation of surcharges is necessary,” says Small.

“The average merchant service fee for small businesses is around 1.2% to 1.5%. This means costs for some businesses will be more, and for other businesses will be less. The Commission expects any surcharges to not exceed costs, and encourages businesses paying more than 1.5% to check if they can get a better deal from their existing or new payment provider. ”

Regulation of surcharging to be considered

Small says the Commission will be doing more work next year to ascertain whether, and to what extent, regulation of surcharges is necessary.

The Commission says interchange fees comprise about 60%, approximately $600 million, of the merchant service fees paid by New Zealand businesses for accepting Mastercard and Visa card payments.

“If our draft decision is implemented, it would significantly reduce the fees businesses pay to make and receive card payments. These fees are high in comparison to many other comparable countries. The fees are also overly complex, hindering a business’ ability to understand their merchant service fees and accurately surcharge,” the Commission says.

Interchange fees are charged by the financial institution, typically a bank, on one side of a payment transaction to the financial institution on the other side of the transaction. A typical card transaction involves four parties the cardholder, the cardholder’s financial institution (the issuer), the merchant and the merchant’s financial institution (the acquirer). For most card transactions, the interchange fee is paid by the acquirer to the issuer.

Visa and Mastercard point out interchange doesn’t generate revenue for them. However it underpins and grows their networks and is the biggest component of merchant service fees paid by merchants to their banks. Interchange can thus drive up costs for merchants and ultimately consumers too, being reflected in retail prices and surcharges, with some also rebated to card holders as rewards.

They’re also complicated. Visa and Mastercard have hundreds of interchange fee categories, impacting the cost and transparency of the merchant service fees paid, merchant service fee pricing and the accuracy of merchant surcharging.

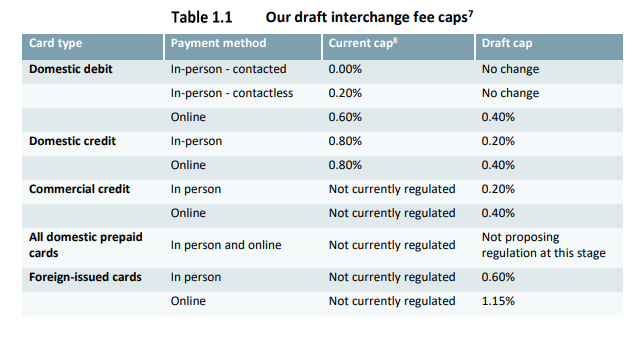

Table 1.1 and notes 7 and 8 come from the Commission’s

7 We note that a flat fee (such as a fee in cents) may be charged so long as that fee complies with the relevant cap when converted to a percentage of the transaction value.

8 These are the specified maximum interchange fee rates from the initial pricing standard. The cap for a transaction is the lower of this specified maximum and the interchange fee as at 1 April 2021.

Below is the full Commerce Commission announcement, issued early Wednesday morning. (There’s also background here, and here).

ComCom issues draft decision to save Kiwis over $260 million a year in payment fees

The Commerce Commission has today issued its draft decision to reduce fees paid by Kiwi businesses for accepting Visa and Mastercard payments. These fees are passed on to consumers through the cost of goods and services, and surcharges.

“We’re proposing a reduction of around $260 million a year to the largest component of the fees charged to New Zealand businesses to receive Visa and Mastercard payments. We’re also setting the clear expectation that payment providers and businesses should pass these savings on to customers,” says Commission Chair, John Small.

In July the Commission revealed consumers spend approximately $95 billion each year using Visa and Mastercard products. New Zealand businesses incur around $1 billion in fees to provide these payment options to their customers.

“This work is the next step to further reduce, and simplify, payment costs for New Zealand businesses, and to save merchants and consumers a considerable amount of money,” says Dr Small.

When someone uses a Mastercard or Visa credit card or makes a contactless payment, such as Paywave, the business receiving the payment is charged a ‘merchant service fee’. It will most likely seek to recover this fee in the form of surcharges or higher retail prices.

Some businesses, whether due to finding it difficult to understand the fees they are being charged or because they seek to make a margin on their cost of payments, set their surcharges higher than the actual merchant services fees.

“We’ve been clear businesses should not be surcharging their customers more than the cost to them of accepting that payment,” says Dr Small.

“Excessive surcharging is not easy to spot. Different businesses pay different fees and the Visa and Mastercard fees are themselves quite complex and variable. Simplifying these fees is also part of our focus.

“If our draft decision is implemented, we’d expect to see consumers benefit from lower surcharges of around 0.7% to 1.0%, or through prices of goods and services that reflect the lower fees. We’ll be doing more work next year to determine whether, and to what extent, regulation of surcharges is necessary,” says Dr Small.

The average merchant service fee for small businesses is around 1.2% to 1.5%. This means costs for some businesses will be more, and for other businesses will be less. The Commission expects any surcharges to not exceed costs, and encourages businesses paying more than 1.5% to check if they can get a better deal from their existing or new payment provider.

The Commission is seeking feedback on this draft decision by 5pm, 18 February 2025. The paper can be found here. Feedback can be submitted to PaymentsTeam@comcom.govt.nz using the submission template found here. Feedback can also be provided using an online form tailored to consumers and merchants.