Sports gambling, particularly through online sports betting platforms, is now legal in 38 states, with nearly $120 billion wagered last year . Some consumers placing bets may be in for a shock, finding their credit card issuer charged $10 or more in “cash advance” fees and added interest for each sports gambling transaction made with a credit card. The CFPB analyzed cash advance fees after the legalization of sports betting in Kansas and Ohio, as well as cardholder agreements, consumer complaints, and online sports betting platforms.

The CFPB found that:

- Issuers that allow consumers to use their credit cards with sportsbooks are largely treating the transactions as cash advances. In a sample of credit card agreements from seven of the top issuers, each lists online gambling or legal wagers as cash advances, although two companies say they “may” decline internet gambling.

- Cash advances can incur high fees as a percentage of the transaction amount and start accruing interest from day one. Cash advance fees often have a minimum charge of $10, making smaller cash advances particularly costly. This means that someone wagering $20 could face the same $10 fee as on a $200 cash advance ATM withdrawal. The most common cash advance APR in reviewed agreements is 30 percent which is charged even if the cardholder would typically not incur interest on regular purchases.

- Credit card use data from Kansas and Ohio suggest that legalizing sports betting corresponded with an increase in cash advance fee incidence. Through the CFPB’s limited analysis of two case studies where the timing of legalizing sports betting lined up with the frequency of our data from major issuers, the percentage of credit card accounts with a cash advance fee spiked in the first month people could legally bet.

- Disclosures made by credit card issuers about cash advance fees for online betting are not always clear or consistent. Consumer complaints provide evidence that some cardholders are caught off guard by cash advance fees and interest on sportsbook transactions. Cardholders cite a lack of transparency on the likelihood of fees from both sportsbooks and credit card issuers as factors increasing confusion around surprise charges.

What is a cash advance?

Cash advances are a feature of many credit cards that allow consumers to obtain cash or cash equivalents for a fee. Using a credit card to withdraw money from an ATM is the most well-known type of cash advance, but certain other transactions that may be considered “cash equivalents” like buying cryptocurrency, making peer-to-peer money transfers, or purchasing lottery tickets could all trigger a cash advance fee. Sports gambling can occur both in person through “retail sports betting” and online, often through an app, but it appears that the vast majority of revenue is through online sportsbooks . Due to the tremendous growth in online sports betting, in particular, we focus on those transactions.

Not all credit card issuers allow consumers to use their cards for online sports betting, but those that do largely treat the transaction as a cash advance. In a sample of recent credit card agreements analyzed by the CFPB, Chase, Discover, and American Express explicitly list online gambling transactions as cash advances. Citi and Capital One classify legal wagers as cash advances but do not call out online gambling. In contrast, Bank of America and Wells Fargo list bets as cash equivalents but also state they “may” decline any transaction identified as internet gambling, presumably relying on merchant categorizations set by networks like Visa and Mastercard. None of the agreements reviewed make explicit whether the bank will definitively allow using the card for online sports betting. Yet mobile sportsbooks take credit cards, and one payment processor reported that one-in-four sports bettors prefer using credit cards to fund wagers.

Cash advances can be expensive, especially for smaller transactions

Our data show that major credit card issuers charged consumers $717 million in fees on $3.6 billion in overall cash advance volume in 2022, representing an average fee around $1 for every $19 spent. Cash advance fees vary based on the size of a transaction. Banks typically charge either a minimum fee or a percentage of the purchase, depending on which is larger. A review of card agreements from the seven issuers listed above found that most charge cash advance fees based on the “greater of $10 or 5%.” This means that someone wagering $20 could face the same $10 fee as on a $200 cash advance ATM withdrawal.

In the weeks following the initial cash advance, the costs will continue to grow: transactions begin accruing interest at a higher cash advance interest rate from the date of the transaction. Say for example, someone had a $400 cash advance balance for one month – at 30% APR, the norm for cash advance rates in the agreements above – the cardholder would incur $10 in interest on top of a $20 cash advance fee (equivalent to an annual interest rate of 90%). This would be true even if the cardholder would typically not incur interest on regular purchases because they pay their balance in full each month by the statement due date. The incremental interest of carrying a cash advance balance for smaller transactions may only equal a few cents, but the final finance charge could be higher, as many issuers have a “minimum interest charge” ranging from $0.50 to over $2. This charge when combined with the minimum cash advance fee can make smaller transactions – on both sports wagers and other cash advance transactions – comparatively costly.

Legal sports gambling may be increasing the incidence of cash advance fees and interest

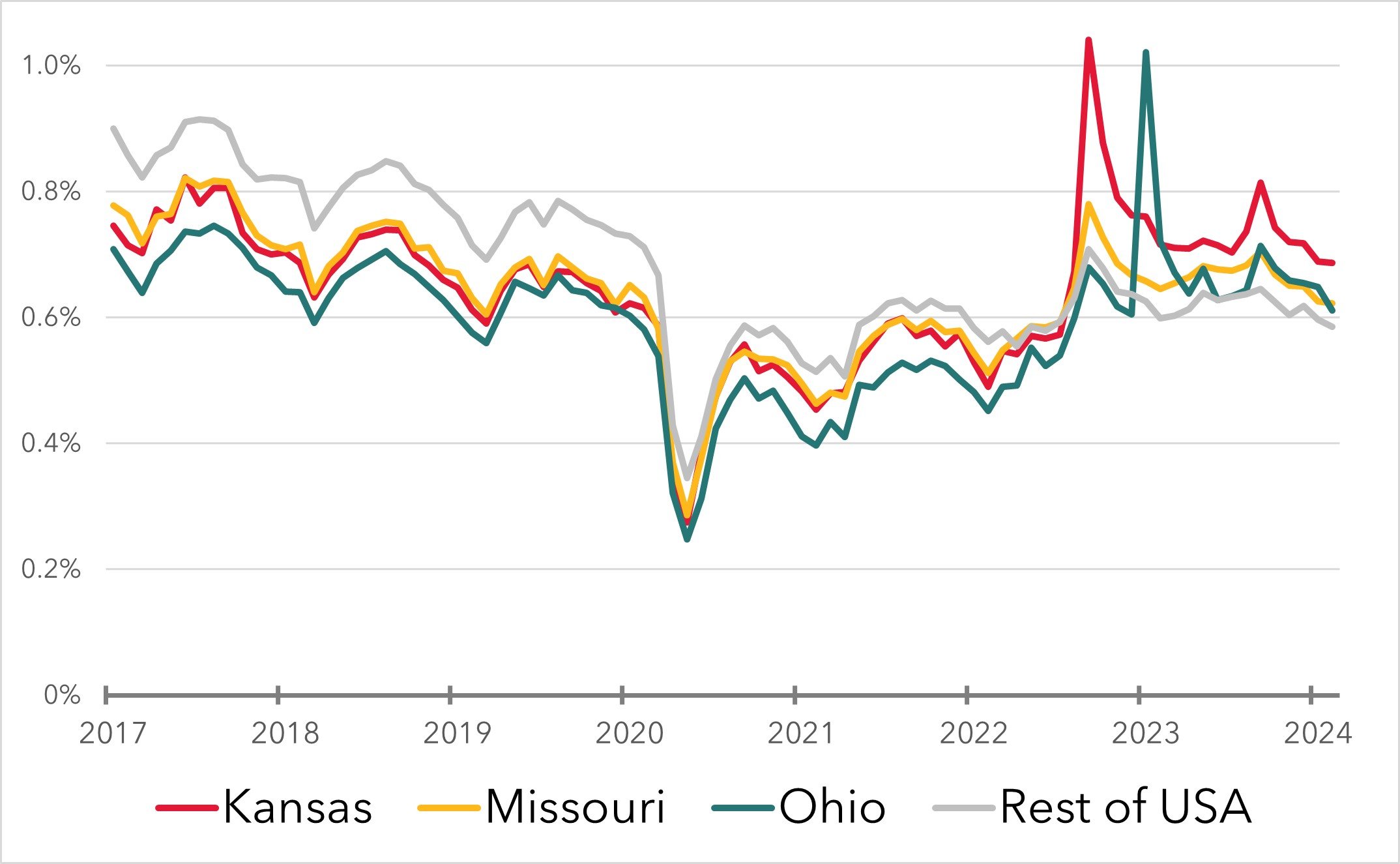

The monthly share of accounts charged a cash advance fee spiked in some states once sports gambling became legal. While correlations between allowing wagers on sports and cash advance fees do not necessarily show a causal relationship, an interesting trend emerges when looking at accounts in Kansas, Missouri, and Ohio.

Figure 1: Monthly cash advance fee incidence for general purpose accounts

Source: Federal Reserve Y-14 data for major issuers representing roughly 70 percent of the credit card market.

First, take Kansas and Missouri: both states have similar demographics and their populations largely support the Kansas City Chiefs. These factors allow us to compare the effect of Kansas, but not Missouri, legalizing sports betting on cash advance incidence before the start of the 2022 NFL regular season (one of the most popular sports for sports gambling). From 2017 through 2021, these states’ cash advance fee rates were nearly identical, and fee prevalence remained below the national average. But Kansas cardholders became far more likely to incur cash advance fees than Missouri consumers that first month sports betting went live. The gap in cash advance fee rates narrowed the next year but still persisted, suggesting cardholders may experience initial confusion about cash advance fees before switching their payment method on a sportsbook. However, even after that first fee, other consumers may continue to rack up credit card charges in the following months.

The cash advance rate for Missourians also rose above the national average, possibly suggesting that some people crossed state lines to place a wager. This cross-contamination of state data may occur because the ability to legally sports bet is based on one’s physical location, often a phone’s GPS if using a mobile app.

Given that some Missouri cardholders may have gone to Kansas to gamble, it is helpful to compare Kansas to a state with consumers less likely to be affected by the change in Kansas law. For this, we next turn to Ohio. Prior to mid-2022, Kansas and the Buckeye State had largely matching trends in cash advance fee incidence, suggesting both were similarly affected by factors like seasonal differences in cash advance demand or changes to major issuers’ policies. The slight increase in Ohio’s September 2022 fee rate suggests that circumstances beyond sports betting being legalized in Kansas might explain a part of the growth in Kansas cash advance fees, as it is far less likely that cardholders from Cleveland traveled to Topeka en masse to place bets.

However, the magnitude of the spike in the Kansas line in Figure 1 is far beyond the bump on the Ohio line. Roughly 8,000 more Kansas accounts incurred a cash advance fee in September 2022 than the month prior. Furthermore, looking at Ohio credit card accounts after legal sports betting launched in January 2023, we see a similar surge in cash advance fees for Bengals and Browns fans. Ohio cash advance fee volume in our dataset increased by over $1 million from December 2022 to January 2023 – for reference, fees increased $9,000 between those months the year before.

Clearly, Kansas and Ohio represent only two of the 38 states that have legalized sports betting. However, circumstances around launching legal sports betting in these states make them particularly appealing case studies. Both legalized retail and mobile sports betting on the first of each month, allowing us to better match up the timing of implementation with fees in our dataset. Sports wagers also became legal for people in these areas (1) post-pandemic, after the decline and subsequent rebound in cash advances in 2020, and (2) during a football season when the desire to gamble may be higher, allowing for better identification of trends.

Consumers report being surprised by cash advance fees on sports betting transactions

Complaints suggest that some consumers are caught off guard by cash advance fees when using their credit card for sports gambling. One person described the charges as “mysterious,” “sneaky,” and “unfair.” Another wrote, “there was nothing when I was entering my payment info on the website to make me feel as though this would be treated any differently from the hundreds of prior transactions I’ve made with a credit card in the past,” and characterized their story as a “warning for others.”

Part of the confusion stems from a lack of transparency on the likelihood of these charges. A number of states ban sportsbooks from accepting credit cards to fund gambling accounts, but for places where it is allowed, sportsbooks provide limited or no disclosure on the potential for cash advance fees. The app may note the possibility of card issuers assessing additional charges in the process of making a payment. Yet some companies only include the warning in small, grey font or characterize the fees as a possibility in their frequently asked questions, rather than the norm.

Even when someone understands banks might charge a cash advance fee, a consumer would struggle to determine whether their particular credit card issuer is in that group. Credit card agreements include fine print on cash advances, but the actual policies of the company change over time and differ based on the particular circumstances of a given transaction. It is difficult to imagine that a consumer would think to refer to their credit card’s terms and conditions when placing a wager for the first time.

Cash advance interest and fees on online sports gambling transactions can be costly for consumers

Cash advance interest and fees on sports gambling are a preventable cost for consumers who could have used a different payment method if they had known about the charges. People have reported being confused by credit card charges in this emerging market, and different companies’ policies are often not clear. Cash advances can also make sports betting costly, as they may incur high fees as a percentage of the transaction amount and start accruing interest from day one. State gaming regulators should consider whether to limit the acceptance of credit cards by online sportsbooks or require special disclosures for online sportsbooks accepting credit cards. In addition, the CFPB will continue to examine how credit card issuers communicate to borrowers on the types of purchases that will incur hefty cash advance fees. The CFPB will also seek to better understand how cash advances for online sports betting affect a consumer’s credit profile.

Footnote

This spotlight was authored by Margaret Seikel, with contributions from Dan Martinez, Sarah Schwartzberg, and Wei Zhang (Office of Markets).