Many Millennial and Gen Z credit union members are financially strapped. But when their institutions hit them with unexpected charges, J.D. Power says many decide it’s time to find a new provider.

By Steve Cocheo, Senior Executive Editor at The Financial Brand

The reason? Fees.

For years, credit unions have pondered the graying of their membership. Now new research from J.D. Power suggests that they could lose whatever ground they’ve gained among Millennials and Gen Z.

The company’s 2025 U.S. Credit Union Satisfaction Study found that fees have become an irritation for members in general, but especially so for younger members. The study reports that 31% of members under 40 say that they “probably will” or “definitely will” leave their credit union in the next 12 months because of a fee they were charged. By contrast, 25% of members 40 and older indicated they were likely to leave.

Another reason for growing dissatisfaction among younger members concerns mobile apps — paradoxically even as credit unions have been laboring to upgrade their mobile offerings.

“For credit unions, digital services are so important, because many don’t have the extensive branch networks that many traditional banks have,” says Dann Allen, senior director of banking and payments intelligence at J.D. Power. “So any time you tamper with that convenience, it can really mess things up.”

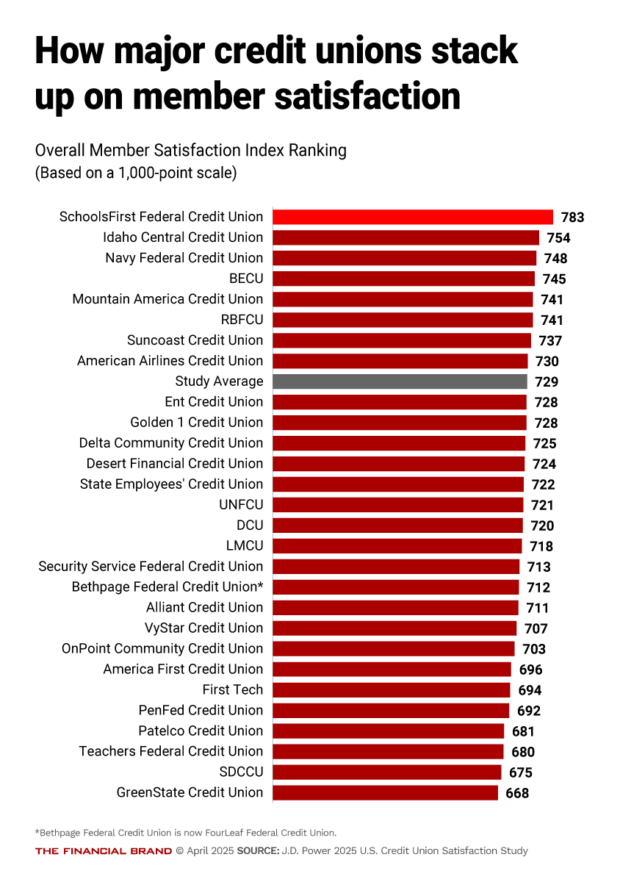

Ironically, these issues are playing out against a backdrop of favorable overall member satisfaction for credit unions. As shown in the chart below, the average rating is 729 for overall satisfaction, out of 1,000 points.

The credit union average in this study is 74 points higher than the average rating for banks in the company’s 2025 U.S. Retail Banking Satisfaction Study. Driving this difference is the superior performance of top-ranked credit unions, in providing member support and convenience. Credit unions as a group outperform banks in all facets of satisfaction measured by both studies.

The firm’s credit union study is in its first year of publication, with a limited first round effort having been conducted in 2024. Allen says a key reason for launching the new survey is that other J.D. Power research has found that 60% of the U.S. population has relationships with both a traditional bank and a credit union. At the same time, consumers will likely have greater credit union options as the industry eliminates legacy membership group requirements, Allen points out.

Why Are Gen Z and Millennials Talking About Leaving Credit Unions?

Allen, a retail banker by background, says that credit unions have a reputation for charging lower fees and paying higher interest than do banks. However, recent events may be eroding the first perception, especially troublesome when other J.D. Power research has found that two thirds of the population is financially unhealthy, particularly for under 40s.

Allen points out that when particular types of fees are examined, credit unions are not always the better deal. Examples are overdraft fees and non-sufficient funds charges. In these areas, in his experience, credit unions are charging such fees to more of their customer bases.

“Overdraft and minimum balance fees are factors that drive dissatisfaction,” says Allen. “They are the last thing that under 40s need, because they’re often struggling to get ahead already, and boom! They get hit with fees.”